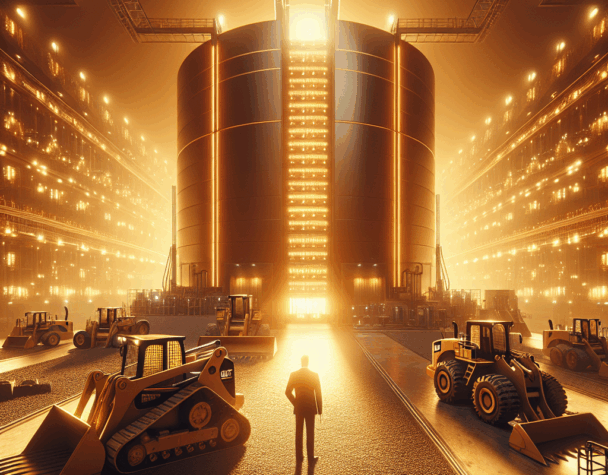

Caterpillar: Bobcat Suit, AI Backlog Surge Boosts!

Wed, December 03, 2025Introduction

In the past week Caterpillar (CAT) has been hit with a substantial legal challenge while also reporting business dynamics that materially affect near- and medium-term revenues. A patent suit filed by Bobcat raises the prospect of monetary damages and import restrictions. At the same time, robust equipment-financing trends and a record backlog in the Energy & Transportation segment — driven in part by AI data-center demand — are delivering tangible demand tailwinds. Together, these events create a mixed but actionable picture for investors following CAT in the DJ30.

Bobcat Patent Suit: Concrete Legal Risk

Bobcat (Doosan) filed lawsuits against Caterpillar in the U.S. (Eastern District of Texas) and at the U.S. International Trade Commission, with parallel complaints in Germany and before the EU Unified Patent Court. The complaints allege that certain Caterpillar dozers, excavators and compact equipment infringe Bobcat’s skid-steer and related loader patents.

What the filings seek

- Monetary damages for alleged infringement.

- Potential trade remedies through the ITC, including import restrictions or bans on specific models.

These are binary, verifiable outcomes rather than vague accusations: court rulings or ITC determinations can impose direct costs or constrain sales channels. For a major OEM like Caterpillar, an ITC import exclusion order could force production changes, rerouting of sales, or settlements — all of which can compress near-term margins and create volatility in the stock.

Demand and Financing: Supportive Fundamentals

Counterbalancing the legal exposure, recent data show persistent strength in equipment finance and end-market demand.

Equipment borrowing and financing

U.S. equipment borrowing rose approximately 5.7% year-over-year in October, with monthly flows on the order of $10.5 billion. Healthy leasing and lending activity — which touches Caterpillar indirectly through Cat Financial and dealer networks — has historically correlated with steadier equipment purchases and replacement cycles, reinforcing short-term order books.

Record backlog in Energy & Transportation

Caterpillar’s Energy & Transportation segment has reported a significant revenue uptick tied to power-generation equipment and systems sold into AI data centers and cloud infrastructure. Revenue in that segment has risen sharply year-to-date, and the backlog stood at a record near $39.8 billion. Partnerships, such as the recent collaboration with Vertiv to combine power and cooling offerings for data centers, accelerate the company’s ability to deliver integrated solutions that large hyperscalers require.

Investor Positioning and Near-Term Outlook

Institutional activity underscores confidence in Caterpillar’s business transformation: notable stake increases by financial managers — along with roughly 71% institutional ownership overall — signal that many long-term investors view the company’s exposure to AI infrastructure as a durable growth avenue.

How these forces interact for CAT stock

- Legal exposure from the Bobcat suit elevates binary downside risk. An adverse ITC decision or a major damages award would be a clear negative catalyst for the stock.

- Strong equipment financing trends and a multi-billion-dollar backlog provide measurable demand support that can sustain revenue and margins even if construction end markets wobble.

- Progress into AI data-center power and cooling solutions represents a structural shift that could re-rate part of the company’s valuation if execution continues and large contracts convert from backlog to revenue.

Conclusion

This week’s developments present both a legal headwind and a business tailwind for Caterpillar. The Bobcat litigation introduces defined downside scenarios that investors need to monitor closely, while robust financing activity and a record Energy & Transportation backlog tied to AI data-center demand are concrete positives that support CAT’s revenue outlook. For portfolio managers and active investors in the DJ30 component, the near-term view will hinge on legal progress and the pace at which backlog converts into delivered sales.