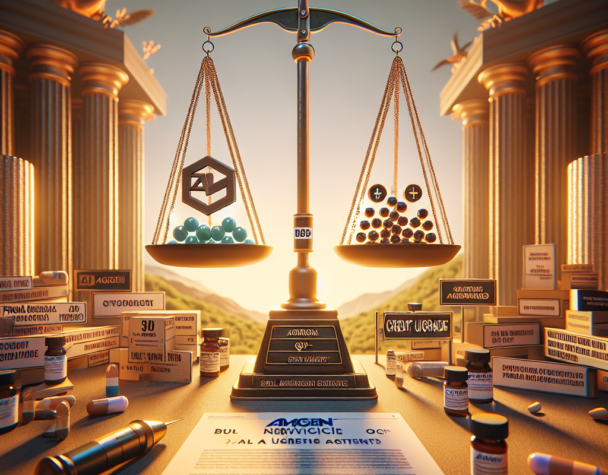

Amgen: Biosimilar Threat vs Fitch Upgrade Strength

Wed, December 24, 2025Introduction

Amgen (AMGN) entered the week with contrasting headlines that matter to shareholders. On one hand, the FDA approved denosumab biosimilars that directly compete with Amgen’s Prolia and XGEVA franchises. On the other, rating agency Fitch upgraded Amgen’s credit profile to BBB+, signaling stronger financial footing. Add a federal drug‑pricing deal, a new label approval, and promising pipeline catalysts, and the company’s near‑term outlook becomes a balancing act between competitive pressure and corporate resilience.

Major developments this week

Biosimilars approved against Prolia and XGEVA

Regulators cleared two denosumab biosimilars for use in indications that overlap with Prolia and XGEVA. These approvals establish new, authorized alternatives in a high‑revenue therapeutic area for Amgen, increasing pricing pressure and potential share loss over time. For a company that relies on durable biologic franchises for steady cash flow, biosimilar entry into these categories is a tangible headwind rather than a hypothetical threat.

Fitch upgrades Amgen to BBB+

Fitch raised Amgen’s long‑term issuer rating to BBB+ with a stable outlook, citing improved leverage metrics and stronger free‑cash‑flow generation following recent strategic transactions. The upgrade reduces refinancing risk, supports the dividend narrative, and enhances flexibility for M&A or pipeline investments.

Drug‑pricing agreement with the U.S. government

Amgen is among several manufacturers involved in a federal drug‑pricing arrangement announced recently. The agreement entails price concessions in return for regulatory or trade offsets. While headline revenue assumptions may need adjustment, the deal also brings more predictability around pricing policy and potential cost offsets that mitigate longer‑term uncertainty.

UPLIZNA approval and MariTide program attention

Amgen secured FDA approval for UPLIZNA in an additional neurological indication, expanding its specialty‑disease portfolio. Separately, the obesity program often referred to as MariTide remains a focal point: pending data readouts carry high optionality, and any early signals — positive or negative — would move the stock materially.

Q3 results: beats and raised guidance

Recent quarterly results showed top‑line strength and an adjusted EPS beat, prompting management to raise full‑year guidance. This operational momentum provides a baseline of support for valuation while management navigates external pressures from biosimilars and pricing policies.

Investor implications and tactical outlook

Short‑term: monitor revenue and pricing impact

With biosimilars now authorized, near‑term attention should center on Amgen’s management commentary about pricing, contract renewals, and share retention strategies for Prolia and XGEVA. Expect incremental margin pressure in the affected franchises; the magnitude will depend on payor uptake of biosimilars and Amgen’s commercial responses.

Balance sheet and dividend resilience

The Fitch upgrade materially improves the company’s financial story. For income investors, a stronger credit rating lowers the risk of dividend disruption and supports capital allocation flexibility for R&D, buybacks, or bolt‑on acquisitions aimed at offsetting biosimilar erosion.

Policy and pipeline as catalysts

The drug‑pricing agreement reduces one category of regulatory uncertainty, even as it may compress list prices. Meanwhile, upcoming clinical readouts — particularly from the obesity program — represent high‑leverage events. Positive efficacy or safety data could meaningfully offset biosimilar pressure; unfavorable results would magnify downside risk.

Conclusion

This week’s news creates a clear two‑sided investment case for Amgen. Biosimilar approvals to denosumab create a near‑term revenue challenge for two established franchises, while the Fitch upgrade and solid quarterly fundamentals reinforce the company’s financial durability. Short‑term volatility is likely as investors digest competitive dynamics and await clinical and commercial responses. Longer‑term outcomes will hinge on Amgen’s ability to defend pricing and share, execute on pipeline milestones, and leverage its stronger credit profile to fund growth initiatives.

Note: This article summarizes factual developments affecting Amgen reported over the past week and synthesizes their likely financial and strategic implications for investors.