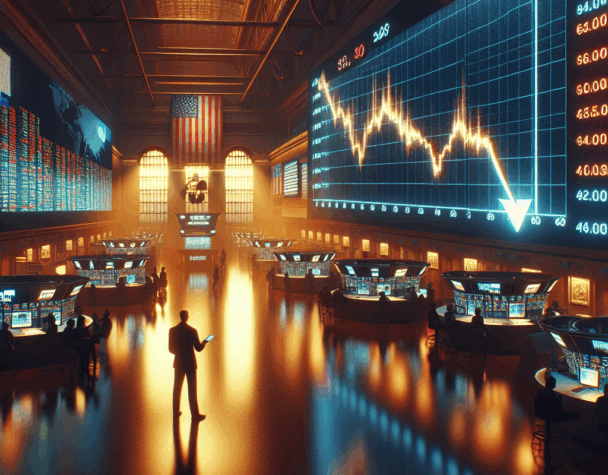

Powell Pause Sends Stocks Lower After Record Highs

Thu, October 09, 2025Stocks retraced gains after a two-part swing: benchmarks hit fresh closing highs, then eased when the Federal Reserve offered little new direction. With investors parsing both Fed cues and company-specific news, the major U.S. indexes moved on a mix of policy uncertainty and earnings-driven surprises.

Indexes’ split reaction: highs then a pause

On Wednesday the S&P 500 and the Nasdaq closed at new records, driven largely by strength in the biggest technology names. The next day, trading tilted lower as Fed commentary failed to clarify the near-term interest-rate path. The Nasdaq and S&P’s earlier momentum morphed into consolidation, while the Dow posted a sharper decline because price-weighted drops in a few expensive components translated into larger point losses.

Why the Dow lagged

The Dow’s structure amplifies moves in high-price stocks. When a handful of large-priced constituents slid—most notably an aerospace heavyweight and a longtime industrial bellwether—the index registered a steeper point decline even though the broader S&P showed only a modest pullback. That mechanical effect explains much of the underperformance relative to cap-weighted gauges.

Fed remarks: little new guidance, more caution

Fed Chair remarks over the session didn’t offer a fresh roadmap for policy, which left traders reluctant to reprice rates aggressively. Officials signaled vigilance on inflation risks, and some Fed voices urged caution about moving too quickly on rate cuts. The net effect: investors shifted from push-driven buying into a wait-and-see posture, favoring consolidation over continued momentum.

How investors reacted

Without clear forward guidance from the Fed, market participants leaned more heavily on corporate results and company guidance to judge growth and margin trajectories. Earnings beats or optimistic outlooks lifted individual sectors, while regulatory or safety probes depressed specific names and their sector peers.

Company headlines that moved stocks

Several corporate stories cut through the Fed noise. An airline reported quarterly results and raised forward expectations, which buoyed travel-related names and helped offset some weakness. In contrast, a major automaker faced a new safety investigation into advanced driver-assist features, which put pressure on that company and weighed on technology- and consumer-discretionary-related groups.

Takeaways for investors

1) Momentum remains, but dispersion is rising: broad indexes can reach new highs while single-name risks cause short-term reversals. 2) Policy ambiguity raises the premium on clear corporate guidance—expect earnings calls and management outlooks to keep driving day-to-day moves. 3) For the Dow specifically, monitor large-priced constituents: isolated declines there can meaningfully skew headline performance.

Bottom line: last session’s headlines produced a classic risk-on follow-by-pause pattern—records one day, selective profit-taking and caution the next—anchored by a lack of new Fed guidance and amplified by specific company developments.