Dow Swings: Record High, 797-Point Drop Shake Tech

Sat, November 15, 2025Introduction

This week brought stark contrasts across U.S. indices: the Dow surged to fresh records, then suffered a dramatic one-day loss, while the Nasdaq and S&P showed divergent behavior driven by firm-specific developments. The immediate catalysts were the resolution of a lingering government shutdown, stakeholder moves in large-cap tech, and uneven corporate guidance. Below is a concise, investor-focused breakdown of the confirmed events and practical takeaways.

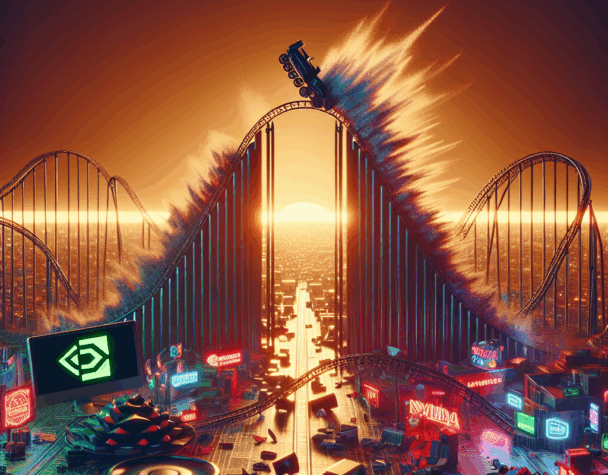

Dow’s Rollercoaster: Record Highs, Then a Sudden Reversal

Early in the stretch, the Dow pushed to new highs, reflecting a brief burst of investor optimism tied to hopes for a shutdown resolution and improving sentiment across cyclical sectors. One session saw the Dow cresting above 48,000—fueling gains in banks, airlines, and consumer-focused names.

What triggered the flip?

When the government reopened and regular economic data began flowing again, the upbeat veneer gave way to underlying concerns: softer employment signals and renewed inflation worries surfaced in the fresh data, and the index plunged roughly 797 points in a single session. Technology-heavy indexes felt the pain as large cap tech and AI-related stocks corrected sharply.

Tech Tremors: Nvidia Stake Sale, CoreWeave Weakness, and AI Name Volatility

Tech dynamics this week were driven by concrete actions and guidance. SoftBank disposed of its entire Nvidia stake, a sizable, tangible sales action that pressured Nvidia shares and rippled through semiconductor suppliers and AI infrastructure names. At the same time, CoreWeave — a key data‑center and GPU cloud provider — issued weak guidance, adding to investor caution about near-term AI demand and capex forecasts.

Why the sell-off mattered

When a major shareholder liquidates a substantial position in a marquee AI chipmaker, it creates both mechanical selling pressure and a psychological recalibration of valuations. Combined with weaker guidance from a top cloud GPU customer, the episode forced investors to re-evaluate near-term revenue trajectories for chipmakers and their ecosystems.

Company Notes That Mattered This Week

Several corporate reports and announcements provided bright spots and headwinds amid the broader swings:

- FedEx raised its holiday-quarter profit forecast, lifting its shares as logistics demand held up.

- Cisco posted stronger-than-expected results, and its shares climbed, underscoring ongoing enterprise spending in networking and AI infrastructure.

- Paramount Skydance rallied despite soft earnings after management outlined deeper cost cuts tied to the acquisition strategy.

- Tesla faced pressure from weak China sales, illustrating how geographic sales slippage can quickly translate into index volatility.

Investor Implications and Tactical Considerations

Think of the recent swings like a spring: pent-up policy and data uncertainty compressed sentiment, and when the shutdown resolved the spring snapped—first upward, then downward once fundamentals re‑entered focus. For investors:

- Reassess exposure to high‑beta AI and semiconductor names in light of confirmed stake sales and mixed guidance; consider trimming positions where valuations rely heavily on uninterrupted, torrid growth.

- Look for secular winners with solid cash flow—companies such as established networking and logistics firms that reported resilient results may offer ballast during volatility.

- Use volatility to rebalance: set clear entry and stop rules rather than reacting to headlines; confirmed corporate actions and earnings beats/misses are more reliable signals than rumor-driven price moves.

Conclusion

This episode underscores a simple lesson: confirmed events—policy developments, large shareholder moves, and company guidance—drive the sharpest, most actionable swings. Record closes and abrupt drawdowns can coexist within days when tangible catalysts collide. Investors who focus on the confirmed data, keep exposure aligned to their risk tolerance, and treat volatility as an opportunity (not merely a threat) will be better positioned for the weeks ahead.