Silver Nears 12-Year High; Solar Demand Surges Now

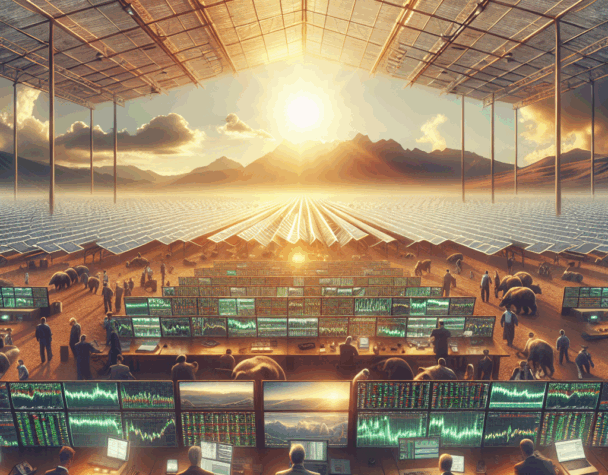

Fri, September 26, 2025Silver has pushed up toward levels not seen in over a decade, driven by a mix of stronger industrial demand, persistent investor interest, and tighter physical availability. Coverage from recent finance reports highlights how silver’s bifold role—as an industrial input and a precious metal—is reshaping price dynamics.

Why silver is rising now

Several forces are converging to lift silver prices. Demand from solar-panel manufacturing and electronics has increased the metal’s industrial consumption, while investors—seeking exposure to precious metals and inflation hedges—have added to ETF and futures flows. At the same time, physical markets are reporting tighter availability in key storage hubs, amplifying price moves when demand spikes.

Industrial demand: solar and beyond

Solar photovoltaic (PV) capacity additions remain a standout driver. Silver’s unique conductive properties make it irreplaceable in many PV designs, so accelerating solar installations translate into steady incremental silver demand. Other industrial uses—such as electronics, medical devices, and certain chemical applications—also support underlying consumption.

Investor flows and physical tightness

Institutional and retail inflows into silver-backed ETFs have been noticeable, reflecting both speculative interest and allocation shifts within commodities. Combined with constrained inventories at physical dealers and some vaults, these flows have a magnified effect on spot prices and nearby futures. Short-term volatility can be high when supply and demand signals cross.

Key price signals and what to watch next

Price and positioning indicators can help anticipate near-term moves. Watch these factors closely:

- Front-month futures: Momentum in front-month COMEX contracts often signals speculative appetite and rollover dynamics.

- ETF flows: Persistent inflows can support a prolonged rally; outflows often presage pullbacks.

- Physical inventory levels: Reports of tightening or easing in major vaults and merchant stocks influence premiums and delivery dynamics.

- Macro cues: Real interest rates, USD direction, and central-bank rhetoric remain important cross-asset drivers.

Risks and potential catalysts

Upside catalysts include additional solar policy support, further ETF accumulation, or a weakening dollar. Downside risks are faster-than-expected supply responses (e.g., recycling picks up), profit-taking after rapid gains, or an abrupt shift in macro conditions that strengthens the dollar or raises real yields.

In short, silver’s near-term strength is grounded in real industrial demand growth—most visibly from solar—together with investor positioning and occasional physical tightness. Traders and investors should keep an eye on futures positioning, ETF flows and inventory reports to gauge whether the move consolidates or corrects.

If you’d like, I can watch live price levels (spot and front-month futures), track daily ETF flows, and push notable headlines from Yahoo Finance as they appear.