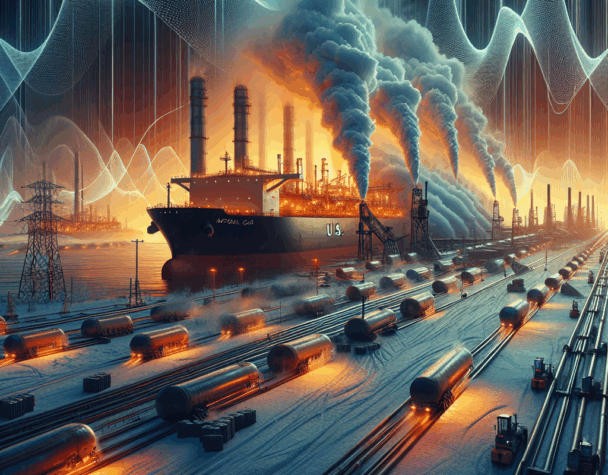

U.S. Natural Gas Jumps on LNG Exports, Cold Upturns

Wed, December 03, 2025U.S. natural gas has moved from tight to tense: stronger-than-expected liquefied natural gas (LNG) exports and early-winter chill pushed benchmark prices toward multi-year highs, while sudden weather-model shifts and regional demand changes produced sharp reversals. These concrete developments over the past week are driving near-term price volatility and reshaping flows across North America, Europe and Asia.

Price drivers: exports and weather

LNG exports tightening U.S. supply

U.S. LNG shipments reached record-scale flows in recent weeks, placing tangible pressure on domestic inventories. November exports climbed to roughly 10.7 million tonnes, drawing on pipeline and storage barrels that otherwise would serve domestic customers. That export surge has been a primary upward force on Henry Hub prices, which moved toward a near three-year high in early December (Henry Hub spot traded in the mid-$4s/MMBtu range as winter demand began to materialize).

Weather swings trigger rapid volatility

Weather remains the short-term price shock absorber: colder-than-normal forecasts for the Northeast and Great Lakes amplified heating demand expectations and supported long positions. Conversely, updated ensemble models projecting milder mid-December temperatures prompted an immediate unwind — the January futures contract dipped about 1.6% on the day those models were released. That sequence underlines how quickly prices can flip when demand assumptions change.

Regional shifts and demand responses

U.S. utilities tilt back to coal

As gas prices rose roughly 40% since September, some U.S. power generators have economically rotated back toward coal where infrastructure and regulatory allowances permit. Coal-fired generation, which emits materially more CO₂ per megawatt-hour than gas, posted a rebound in October–November output. For gas investors, this represents a partial, price-driven demand offset: higher gas prices can depress power-sector gas burn if coal remains cheaper on a delivered-cost basis.

Europe ramps LNG imports; Germany accelerates terminals

In Europe, policy and security considerations continue to accelerate LNG terminal builds. Germany has prioritized floating storage and regasification units (FSRUs) and upgrades at ports such as Brunsbüttel and Wilhelmshaven, with plans to expand volumes at Mukran toward an 18.5 bcm annual capacity by the mid-2020s. Those additions increase Europe’s ability to absorb spot LNG cargoes, shifting some global flows westward and influencing where U.S. cargoes ultimately land.

Asia’s price sensitivity cools demand growth

High spot prices are cooling Asian import growth. China’s LNG imports have eased year-on-year (estimates in the past week put 2025 imports near the mid-60s million tonnes vs. a higher 2024 level), while Japan’s purchases rose modestly. When Asian offtake softens, U.S. cargoes can redirect to Europe, but persistent high prices risk lower overall global demand and greater volatility in cargo routing decisions.

Implications for investors and near-term outlook

Short term, price action will continue to revolve around three observable drivers: (1) weekly weather-model updates and resulting heating-degree forecasts, (2) U.S. LNG load factors and cargo nominations, and (3) power-plant fuel economics (coal vs. gas) in response to sustained price moves. Concrete datapoints to watch: weekly EIA storage reports, the daily LNG export nominations and terminal send-out, and near-term ensemble weather runs for key population centers in the Northeast and Midwest.

For commodity investors, the current environment favors active risk management. Hedging exposures around realized cold-snaps can protect against short squeezes, while options strategies can capture upside from export-driven rallies without full directional exposure. Portfolio managers should also monitor policy developments tied to export permitting and local utility replenishment decisions; these can materially alter domestic supply balances and retail-consumer electricity and heating costs.

Conclusion

The past week has shown that tangible, near-term events — stronger U.S. LNG exports, concrete weather forecasts, and fuel-switching by utilities — are the primary drivers of price moves in natural gas. Those factors have pushed prices higher but left the path forward highly contingent on weather persistence and regional demand responses. Investors who track export flows, storage changes and the next weather model run will be best positioned to navigate the coming volatility.