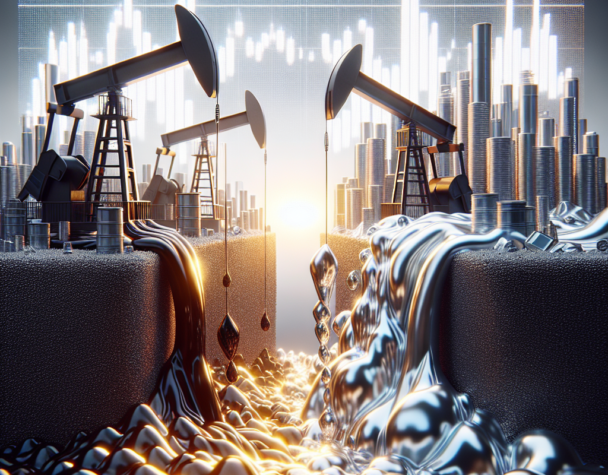

Oil Glut Set to Crush Prices; Silver Tops $60 Now!

Sat, December 13, 2025Introduction

Two clear, actionable developments arrived in commodity headlines this week: a looming oil surplus that analysts say will depress crude into 2026, and a sharp rally in silver that pushed the metal above $60 per ounce. Both stories are rooted in verifiable supply-and-demand shifts and carry distinct implications for producers, consumers and investors across energy and metals sectors.

Oil oversupply poised to weigh on prices in 2026

What the data shows

Major trading houses and industry economists have flagged a sizeable surplus building in the oil complex. Reports cite accelerating production from Brazil and Guyana, sustained high U.S. output and softer demand growth in parts of Asia as central contributors. As a result, benchmark Brent crude has already fallen materially this year, and some analysts see scope for prices to move below the $60-per-barrel threshold in early 2026.

Primary drivers

- New supply coming online: Large offshore projects in Brazil and expanding output in Guyana are adding barrels at pace, while U.S. producers remain active.

- Demand headwinds: Slower consumption growth in China and structural shifts toward electrification in transport are tempering demand expansion.

- Inventory dynamics: When production outpaces consumption, inventories increase and place downward pressure on prices—an effect now being observed in seaborne crude and storage hubs.

Immediate implications

Lower crude prices have a ripple effect beyond energy desks. Near-term consequences include reduced revenue for oil-dependent governments and producers, downward pressure on inflation via cheaper fuel, and potential re-pricing across commodities tied to energy costs—such as fertilizers and certain industrial metals. Shipping and logistics costs may ease if bunker fuel prices decline, while capital expenditure plans for higher-cost projects may be re-evaluated.

Silver breaks $60 — supply squeeze tightens

Price action and context

Silver climbed past $60 per ounce this week, reaching roughly $60.40 in a session that marked a sharp uptick. The metal has performed strongly over the past year, driven by persistent supply deficits, slower-than-expected mine expansion, and heightened industrial and investor demand. One-session gains of around 4% underscore elevated volatility and the concentrated nature of current positioning.

Key factors behind the rally

- Structural supply shortfalls: Mining expansions have lagged demand growth, leaving deficits that accumulate over multiple years.

- Broader demand mix: Robust industrial use (electronics, solar panels), jewelry consumption, and renewed investor interest have all supported higher prices.

- Policy and sentiment: Recent policy moves—such as placement of silver on critical mineral lists and expectations of interest-rate cuts—have encouraged speculative and strategic buying by institutions and retail investors.

Who is affected most

Higher silver benefits miners and holders of physical metal or bullion-backed instruments, while industrial buyers and manufacturers face higher input costs. Countries and companies with large silver exposures will see margin impacts, and financial flows may shift into precious metals as a hedge when interest-rate expectations change.

Cross-commodity linkages and practical takeaways

Although these stories involve different commodities, they intersect through energy costs, financing conditions and investor flows. Lower oil can reduce production costs for energy-intensive mining operations, potentially offsetting some margin pressure from higher metal prices. Conversely, cheap energy can discourage capital investment in higher-cost mining projects, which may prolong metal supply constraints.

- For producers: Oil companies should prepare for sustained price pressure that may force production prioritization; miners should model input cost changes and plan hedging for metal price swings.

- For industrial users: Locking in energy contracts could be prudent if lower oil materially reduces operating costs; buyers of silver-intensive components should consider hedging or negotiating forward purchase terms.

- For investors: The divergence—weakening crude and strengthening silver—creates opportunities for relative-value trades across energy and precious-metals exposures, but elevated volatility warrants disciplined risk management.

Conclusion

Recent, concrete developments point to a bifurcated commodity backdrop: an emerging oil surplus that is likely to depress crude prices into 2026, and a concentrated supply squeeze in silver that has pushed the metal above $60 per ounce. These trends are rooted in measurable production increases, demand shifts and policy signals. Stakeholders across energy, metals and finance should adjust planning and risk frameworks to reflect cheaper fuel costs alongside tighter precious-metals supplies and ongoing price volatility.