EA $55B Takeover & U.S. Tariffs Hit Home Stocks Now

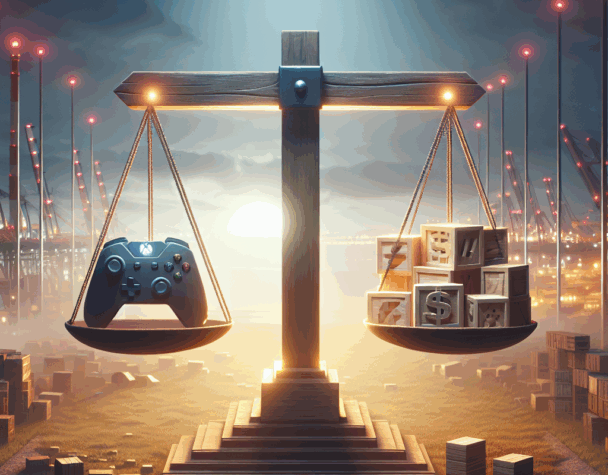

Tue, September 30, 2025Two concrete developments moved headline risk for major U.S. indices in the last 24 hours: a landmark take‑private agreement for Electronic Arts and a new set of U.S. tariffs on wood products and furniture. Both have clear, traceable consequences for index composition, sector earnings pressure, and short‑term trading flows.

EA’s $55 billion take‑private deal: what happened

Electronic Arts agreed to be acquired in an all‑cash transaction valued at roughly $55 billion, financed by a consortium including Silver Lake, the Saudi Public Investment Fund and other investors. The offer price is a substantial premium to EA’s recent trading levels and represents one of the largest leveraged buyouts recorded in the sector.

Index and investor implications

- Index composition: Once the deal closes, EA — currently part of Communication Services and tracked by the S&P 500 and Nasdaq — will be removed from free‑float indices. Passive funds and ETFs that track those indices will need to rebalance, triggering predictable buy/sell flows in the near term.

- Sector concentration: Communication Services weights will modestly shift, benefiting remaining constituents by relative weight increase; sector‑specific ETFs may see short‑term volatility as funds execute rebalances.

- Valuation and M&A signaling: A buyout at a high multiple could spur takeover chatter across blue‑chip gaming and media names, but the direct, concrete effect now is mechanical index reweighting and potential single‑stock price dislocations.

U.S. tariffs on lumber, cabinets and furniture: the facts

The administration announced new import duties under Section 232: a 10% tariff on lumber and higher initial rates — 25% on certain kitchen cabinets, bathroom vanities and upholstered furniture — with the possibility of further hikes in the coming year. The tariffs target specific product lines and trade partners, and they have immediate pass‑through and margin implications for U.S. companies that import these goods.

Who is affected and how

- Homebuilders and building‑products suppliers: Higher import costs for key materials and components can squeeze margins or force price increases, which could weigh on near‑term revenue guidance.

- Retailers and specialty furniture chains: Those that rely on imports from targeted countries may face higher landed costs; retailers with pricing power can attempt to pass costs to consumers but may face demand elasticity headwinds.

- Supply‑chain and geographical exposure: Companies with diversified sourcing or domestic production will fare better; names with concentrated exposure to affected exporters will be most pressured.

Combined index-level effects

Together, the EA transaction and the tariffs create a mix of mechanical and fundamental forces. EA’s buyout is largely mechanical — triggering passive rebalances and potential temporary volatility in Communications and large‑cap tech weightings. The tariffs introduce a fundamentals channel that elevates downside risk for housing‑adjacent and consumer discretionary stocks, which can drag on the S&P 500 and Dow given their sector footprints.

Practical takeaways for investors

- Expect short‑term trading flows around index rebalancing: watch funds tracking S&P 500 and Nasdaq for volume spikes when the removal is implemented.

- Monitor earnings guidance and supplier commentary: firms in building products, home improvement retail and furniture should be first to update guidance or announce pricing actions.

- Reassess concentration risk: funds with heavy Communication Services or housing exposure should check how the changes affect sector weights and tracking error.

Both stories are concrete, non‑speculative events with clear operational and mechanical consequences. For traders, the immediate opportunities are around rebalancing flows and short‑term sector rotation; for longer‑term investors, the tariffs warrant scrutiny of profit‑margin trajectories in housing‑linked companies while the EA deal is primarily a one‑off that reshapes index composition.