Trump's New Tariffs and Nvidia's AI Expansion Impact Markets

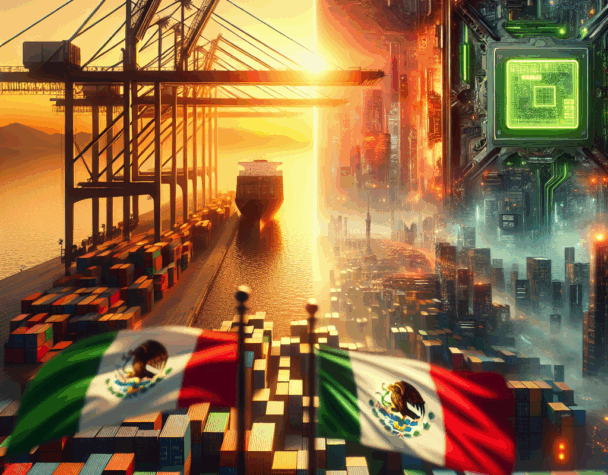

Sun, July 20, 2025In recent developments, the investment landscape has been significantly influenced by two major events: President Donald Trump’s announcement of new tariffs on Mexico and the European Union, and Nvidia’s strategic expansion in the artificial intelligence (AI) sector.

President Trump’s New Tariffs: A Global Economic Shift

On July 16, 2025, President Trump announced the imposition of 30% tariffs on imports from Mexico and the European Union, set to take effect on August 1. This decision has reignited concerns about escalating trade tensions and their potential impact on the global economy. The announcement led to immediate market reactions, with the Dow Jones Industrial Average and the S&P 500 experiencing declines as investors grappled with the implications of a potential trade war. Analysts warn that such tariffs could disrupt supply chains, increase production costs, and ultimately affect consumer prices. The European Union has indicated that it may respond with countermeasures, further intensifying the situation. Investors are advised to monitor these developments closely, as prolonged trade disputes could lead to increased market volatility and affect global economic growth.

Nvidia’s AI Expansion: A Boon for Tech Investors

In contrast to the turbulence in trade relations, the technology sector received a boost from Nvidia’s recent announcement. The AI giant revealed plans to resume sales of its H20 AI chips to China, following assurances from the U.S. government that necessary licenses would be granted. This move is expected to strengthen Nvidia’s position in the lucrative Chinese market and bolster its revenue streams. The news was met with enthusiasm by investors, leading to a 4% surge in Nvidia’s stock price and contributing to the Nasdaq Composite’s positive performance. Nvidia’s strategic expansion underscores the growing importance of AI technologies in various industries and highlights the company’s commitment to maintaining its leadership in the sector. For investors, this development presents potential opportunities in the tech market, particularly in companies that are at the forefront of AI innovation.

Market Implications and Investor Strategies

The juxtaposition of these events presents a complex scenario for investors. On one hand, the introduction of new tariffs introduces uncertainty and potential risks associated with international trade disputes. On the other hand, advancements in AI and technology sectors offer promising growth prospects. Investors are encouraged to adopt a diversified portfolio approach to mitigate risks associated with geopolitical tensions while capitalizing on opportunities in emerging technologies. Staying informed about policy changes and technological advancements will be crucial in navigating the evolving investment landscape.

In conclusion, the recent developments in trade policies and technological advancements are reshaping the investment environment. While challenges persist due to geopolitical tensions, the continued growth and innovation in the tech sector provide avenues for potential gains. Investors should remain vigilant, adaptable, and informed to effectively navigate these dynamic market conditions.