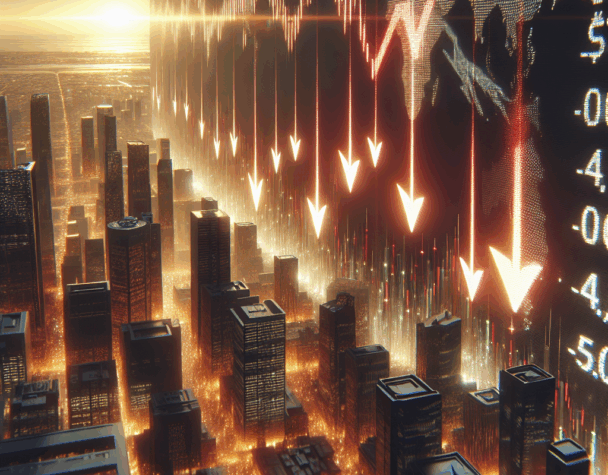

Tariffs and Tech Earnings Trigger Market Turmoil

Sun, August 03, 2025The U.S. stock market faced a tumultuous session on August 1, 2025, as a combination of aggressive new tariffs and underwhelming tech earnings reports sent major indices into a tailspin. The Dow Jones Industrial Average plummeted 770 points, marking its steepest single-day decline since March. Similarly, the S&P 500 and Nasdaq Composite fell by 1.6% and 2.2%, respectively, reflecting widespread investor anxiety. (stl.news)

Escalating Trade Tensions

President Donald Trump announced sweeping new tariffs ranging from 10% to 41% on imports from key trading partners, including the European Union, India, Japan, and Canada. This move, aimed at addressing “unfair trade practices,” has intensified fears of a full-blown trade war. Analysts warn that these tariffs could stifle corporate profits, increase consumer prices, and strain international relationships at a time when economic growth is already under pressure. (stl.news)

Tech Sector Under Pressure

The technology sector, which has been a significant driver of market gains in 2025, faced substantial setbacks. Amazon reported lower-than-expected forward guidance, leading to a more than 7% drop in its stock price. This decline dragged down the broader Nasdaq Composite, with other tech giants like Microsoft, Alphabet, and Nvidia also experiencing sharp declines. The sector’s weakness has raised concerns that recent tech-led gains may be overextended, especially if consumer demand softens amid rising tariffs and slowing job creation. (stl.news)

Market Outlook

The confluence of escalating trade tensions and disappointing tech earnings has created a challenging environment for investors. Market volatility is expected to remain high as stakeholders assess the potential long-term impacts of these developments. Investors are advised to stay informed and consider diversifying their portfolios to mitigate risks associated with ongoing market fluctuations.

For a detailed analysis of the recent market downturn, refer to the comprehensive report by STL.News. (stl.news)

Additionally, insights into the broader economic implications of the new tariffs can be found in the article by MoneyWeek. (moneyweek.com)

In conclusion, the recent market turmoil underscores the interconnectedness of trade policies and corporate performance. Staying abreast of policy changes and corporate earnings reports is crucial for navigating the current investment landscape.