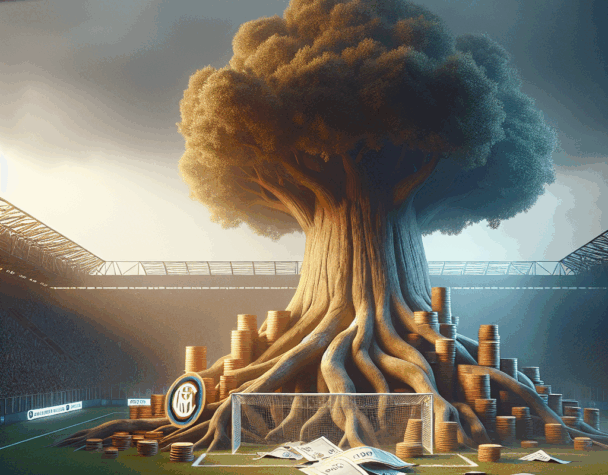

Oaktree Capital Takes Control of Inter Milan Amid Financial Turmoil

Tue, June 03, 2025Oaktree Capital Takes Control of Inter Milan Amid Financial Turmoil

In a significant development in the world of football finance, Oaktree Capital, a U.S.-based distressed debt investor managing $203 billion in assets, has assumed control of the renowned Italian football club Inter Milan. This move comes after the club’s previous owner, Suning, defaulted on a €400 million loan. The club was valued at €1 billion during this transition. Oaktree’s Italian football foray

Background and Financial Challenges

Inter Milan, one of Italy’s most storied football clubs, has faced financial difficulties in recent years. Suning, a Chinese conglomerate, acquired a majority stake in the club in 2016. However, the company struggled to manage the club’s debts, leading to the default on a substantial loan. This default triggered Oaktree Capital’s intervention, as they held the loan and subsequently took over the club’s ownership.

Oaktree’s Turnaround Strategy

Upon taking control, Oaktree initiated a 100-day turnaround strategy aimed at stabilizing Inter Milan both financially and operationally. Key steps in this strategy include:

- Leadership Overhaul: Promoting Giuseppe Marotta to the roles of president and CEO, signaling a new direction for the club’s management.

- Revenue Enhancement: Focusing on improving revenue streams through renegotiated sponsorships and innovative commercial strategies.

Despite these efforts, the turnaround has faced delays due to the complex operational environment in Italy, which presents unique challenges in implementing swift changes.

Stadium Redevelopment: A Long-Term Challenge

One of the most significant long-term challenges for Oaktree and Inter Milan is the redevelopment of the aging San Siro stadium, which the club shares with AC Milan. The stadium’s modernization is fraught with political and logistical complexities, making it a focal point for the club’s future plans.

Broader Investment Trends

Oaktree’s acquisition of Inter Milan is part of a broader trend of investment firms entering the sports industry. This move reflects a growing interest in leveraging the global appeal and revenue potential of major sports franchises. For instance, Japan’s Dai-ichi Life recently announced its acquisition of a 15% stake in UK asset management firm M&G, highlighting the increasing globalization of investment strategies. Oaktree’s Italian football foray

Market Implications

The financial markets have responded to these developments with cautious optimism. The involvement of a major investment firm like Oaktree in European football underscores the potential for financial restructuring and growth within the industry. However, the success of such ventures depends on effective management and the ability to navigate complex regulatory and operational landscapes.

Conclusion

Oaktree Capital’s takeover of Inter Milan marks a pivotal moment for the club and highlights the increasing intersection between high finance and professional sports. As Oaktree implements its turnaround strategy, the football world will be watching closely to see if this financial intervention can restore Inter Milan to its former glory both on and off the pitch.