Inflation Rises to 2.7%; Nvidia Resumes China Chip Sales

Wed, July 16, 2025On July 15, 2025, the financial landscape experienced significant developments, notably the unexpected rise in inflation and Nvidia’s strategic move to re-enter the Chinese market.

Inflation’s Unexpected Climb

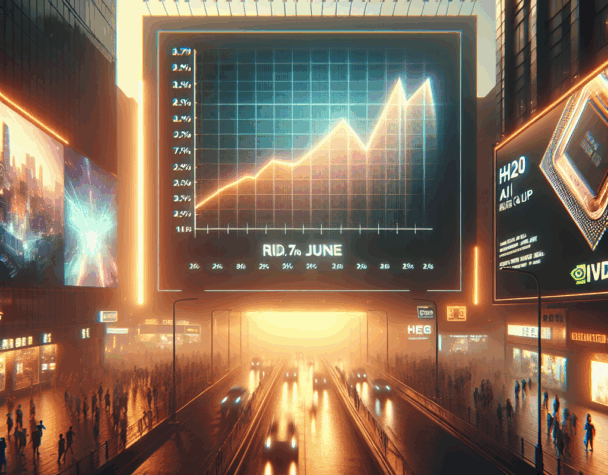

The U.S. Consumer Price Index (CPI) revealed a 2.7% increase in June, up from 2.4% in May. This uptick has tempered expectations for imminent interest rate cuts by the Federal Reserve. The S&P 500 responded with a 0.4% decline, closing at 6,243.76, while the Dow Jones Industrial Average fell 1% to 44,023.29. In contrast, the Nasdaq composite edged up 0.2% to a record 20,677.80, driven by gains in the technology sector. The Russell 2000, representing smaller companies, saw a more significant decline of 2% to 2,205.05. (apnews.com)

Nvidia’s Strategic Re-entry into China

Amid these macroeconomic shifts, Nvidia announced plans to resume sales of its H20 AI chips to China. This decision follows assurances from the U.S. government regarding license approvals. The news propelled Nvidia’s stock up by 4%, contributing to the Nasdaq’s positive performance. (apnews.com)

Implications for the Semiconductor Industry

Nvidia’s move is poised to influence the semiconductor industry significantly. By re-entering the Chinese market, Nvidia not only expands its revenue streams but also sets a precedent for other tech companies navigating complex trade regulations. This development underscores the intricate balance between regulatory compliance and market expansion strategies.

Conclusion

The juxtaposition of rising inflation and Nvidia’s strategic maneuver highlights the multifaceted nature of the current financial environment. Investors are advised to stay informed and consider both macroeconomic indicators and individual corporate actions when making investment decisions.