Global Currency Markets React to Economic Data and Trade Tensions

Thu, June 05, 2025Dollar Weakens Amid Soft U.S. Economic Data

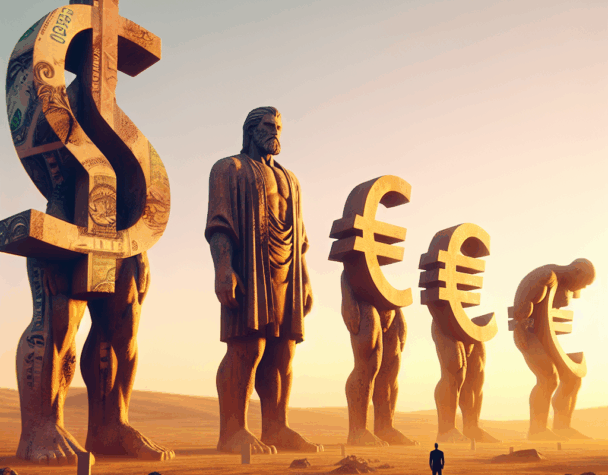

The U.S. dollar experienced a decline on Thursday, influenced by disappointing economic indicators and ongoing trade uncertainties. Recent data revealed that the U.S. services sector contracted in May for the first time in nearly a year, coupled with a slowing labor market. These factors have heightened concerns about economic growth and rising inflation. Consequently, Treasury yields fell, and expectations for Federal Reserve rate cuts increased, with markets pricing in a 95% chance of easing by September. President Trump has renewed pressure on the Fed to cut rates following weak employment data, causing further investor unease about the Fed’s independence. The dollar has depreciated about 9% this year, heading for its weakest performance since 2017. Market movements were generally subdued as investors await crucial U.S. payroll data on Friday. Meanwhile, trade tensions and lack of progress in U.S.-China negotiations are adding to global uncertainty. The European Central Bank is anticipated to cut interest rates by 25 basis points, aiming to support a faltering eurozone economy. Economists suggest the ECB may pause its easing cycle depending on incoming data, as global recession risks appear to be falling. Dollar feeble on soft economic data, trade uncertainties

Euro Gains as ECB Signals Potential Rate Cuts

The euro has strengthened as the European Central Bank (ECB) prepares for another interest rate cut. Analysts suggest that even modest shifts in currency reserve allocations can drive massive capital flows. A return of the euro to its 2009 reserve share of 28%, up from the current 20%, could translate to up to $1 trillion in new euro-denominated assets. This would significantly impact the euro’s value and European economic dynamics, potentially forcing the ECB to cut interest rates further to offset declining inflation and growth forecasts. While this surge could boost demand for core euro government bonds, it might also bring challenges similar to those faced by the Swiss National Bank, including unwanted currency strength. ECB President Christine Lagarde’s rhetoric is expected to play a key role in managing the pace of the euro’s appreciation to mitigate adverse economic effects. Ultimately, the expansion of the “global euro” could bring both benefits and sizable risks. Euro needn’t dethrone dollar to draw reserve flood

Yen Strengthens Amid Safe-Haven Demand

The Japanese yen has reached a five-month high against the U.S. dollar, driven by increased safe-haven demand and speculation over potential interest rate hikes by the Bank of Japan. Investors are seeking refuge in the yen amid global economic uncertainties and trade tensions. The yen’s appreciation reflects market sentiment favoring stability in times of economic volatility. Japanese yen hits 5-mth high on haven demand, BOJ rate hike bets

Emerging Market Currencies Show Mixed Performance

Emerging-market currencies have exhibited varied performance as markets digest recent Federal Reserve decisions. The Colombian peso and the Polish zloty led gains, while other currencies faced challenges due to global trade tensions and economic uncertainties. The MSCI Inc. gauge of emerging-market currencies rebounded from earlier losses, rising 0.1% as investors unpack the Fed decision to keep rates on hold for the fourth straight meeting and Powell’s speech, which damped speculation that rate cuts would start at the next meeting in March. Latin American currencies are among the best performers, with the Colombian peso gaining 0.7%, while the Brazilian real and the Mexican peso strengthened 0.8% and 0.6%, respectively. In contrast, the Chilean peso led losses in the region after its central bank delivered a full percentage point rate cut and its economic activity in December posted its biggest monthly decline since July 2022. In Brazil, policymakers cut its key interest rate by half a percentage point, while Chile’s central bank slashed rates by a full point. Emerging-Market Currencies Rise as Markets Digest Fed Decision

Conclusion

The global currency markets are currently navigating a complex landscape shaped by economic data releases, central bank policies, and geopolitical developments. Investors are closely monitoring these factors to make informed decisions in an environment marked by uncertainty and volatility.