Global Clean Energy Investments Surge, Outpacing Fossil Fuels

Thu, June 12, 2025Global Clean Energy Investments Surge, Outpacing Fossil Fuels

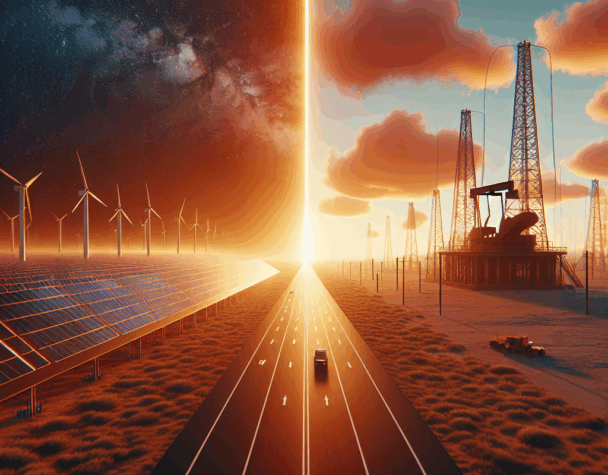

In a significant shift towards sustainability, global investments in clean energy are projected to reach $2.2 trillion in 2025, effectively doubling the $1.1 trillion allocated to fossil fuels. This trend underscores a growing commitment to renewable energy sources and a move away from traditional coal, gas, and oil investments.

Key Highlights from the International Energy Agency (IEA) Report

- Renewable Energy Dominance: The $2.2 trillion investment encompasses renewables, grid technologies, storage solutions, and nuclear energy, marking a decisive pivot towards cleaner energy sources.

- Electricity Sector Growth: Investments in the electricity sector are set to reach $1.5 trillion, surpassing the combined spending on oil, natural gas, and coal by 50%.

- Regional Insights: China’s share of global clean energy investment has risen from 25% to 33% over the past decade. However, the country continues to approve new coal-fired power plants, indicating a complex energy strategy.

- Data Center Demand: The burgeoning energy needs of data centers are expected to necessitate over $170 billion in new power generation investments, influencing both clean and fossil fuel sectors.

Despite the surge in clean energy investments, global demand for coal, gas, and oil remains on the rise, particularly in rapidly developing economies like China and India. This dual trend highlights the ongoing challenges in transitioning to a fully sustainable energy landscape.

For a comprehensive analysis, refer to the IEA’s detailed report on global energy investments. (axios.com)

Implications for Investors

The substantial increase in clean energy investments presents both opportunities and challenges for investors:

- Emerging Markets: Companies specializing in renewable energy technologies are poised for growth, offering potential high returns.

- Policy Influence: Government policies and international agreements will play a crucial role in shaping the investment landscape, necessitating careful monitoring.

- Technological Innovations: Advances in energy storage, grid management, and nuclear technologies could redefine market dynamics, impacting investment strategies.

Investors are encouraged to stay informed about policy developments and technological advancements to make strategic decisions in this evolving sector.

Conclusion

The projected doubling of clean energy investments over fossil fuels by 2025 signifies a pivotal moment in the global energy transition. While challenges remain, particularly in balancing energy demands with sustainability goals, the trend offers promising avenues for investors and underscores the importance of continued innovation and policy support in the clean energy sector.