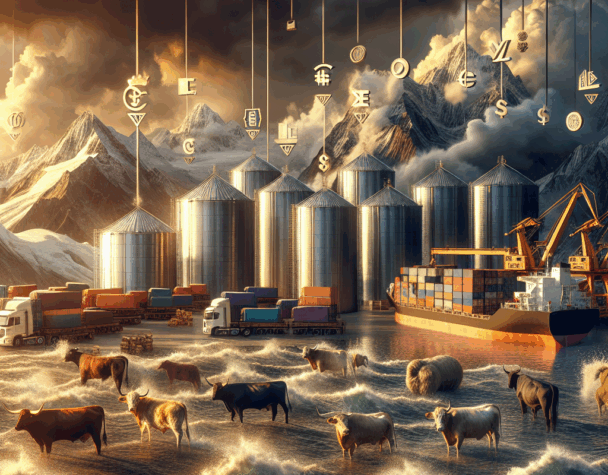

Commodity Markets Experience Volatility Amid Global Trade Uncertainties

Wed, June 11, 2025Commodity Markets Experience Volatility Amid Global Trade Uncertainties

As of June 11, 2025, commodity markets are exhibiting significant volatility, influenced by ongoing global trade negotiations and geopolitical developments.

Oil Prices React to U.S.-China Trade Talks

Oil prices have shown fluctuations in response to the latest U.S.-China trade discussions. Brent crude increased by 28 cents to $67.32 per barrel, while U.S. West Texas Intermediate rose 23 cents to $65.52. These gains follow Monday’s price increase, driven by hopes of a potential trade deal and a strong U.S. jobs report. U.S. President Donald Trump indicated optimism regarding the talks. Analysts suggest that a resolution could support global economic growth and commodity demand. Oil up as market watches US-China trade talks

Gold Prices Reach New Highs Amid Market Uncertainty

Gold prices have surged to record levels, reflecting investor concerns over market volatility. The precious metal of 99.9 percent purity extended gains for the fourth day in a row, rallying Rs 1,300 to hit a fresh peak of Rs 90,750 per 10 grams. Gold, silver surge Rs 1,300 to record highs in Delhi on strong global cues

Indonesia’s Dominance in Nickel Production Raises Global Concerns

Over the past decade, Indonesia has transformed into the dominant global force in nickel production, growing its market share of refined nickel from 6% to 61%. This shift stemmed from a pivotal 2014 government decision to ban raw nickel ore exports, aimed at capturing greater value and attracting foreign investment. The ban prompted Chinese companies, which previously purchased unprocessed ore, to invest heavily in refining facilities within Indonesia. As a result, Chinese stakeholders now control the vast majority of Indonesia’s nickel processing capacity. Transcript: How Indonesia cornered the nickel market

Global Food Prices Decline in May

In May 2025, global food commodity prices declined, with the FAO Food Price Index dropping by 0.8% from April to 127.7 points, though still 6% higher than the previous year. This dip was mainly due to significant reductions in cereal, sugar, and vegetable oil prices. Cereal prices fell 1.8%, driven by global maize price drops from strong harvests in Argentina and Brazil and expected record yields in the U.S. Wheat prices also declined, while rice prices slightly increased by 1.4% due to strong demand and currency effects. Vegetable oil prices saw a 3.7% decrease, with declines across all major oils including palm, soy, rapeseed, and sunflower oil attributed to seasonal increases and weak demand. The sugar price index dropped 2.6% amid global economic concerns and anticipated production recovery. Meat prices rose 1.3%, with beef hitting a record high, while poultry prices fell due to surplus in Brazil. The dairy index rose 0.8%, driven by strong Asian demand and historically high butter prices. The FAO also forecast a record global cereal production of 2.911 billion metric tons in 2025, with expectations of a 1.0% increase in global cereal stocks, reversing last year’s decline. World food prices dip in May as cereal, sugar and vegoils drop

Market Outlook

Commodity markets are expected to remain volatile as global trade negotiations continue and geopolitical tensions persist. Investors are advised to stay informed and consider diversifying their portfolios to mitigate potential risks.

For more detailed information on commodity market trends, visit reputable financial news sources and consult with financial advisors.