Tariffs Hit U.S. Pharma;Turkish Airlines 225 Jets!

Fri, September 26, 2025Two concrete, high-impact developments broke in the last 24 hours that investors should track: a U.S. tariff package with immediate effective dates and a large aircraft purchase by Turkish Airlines that reshapes aerospace delivery schedules. Both are event-driven — not forward-looking speculation — and they have specific timelines, counterparties and measurable second-order effects.

U.S. tariff package: what was announced and when it takes effect

The administration announced a new set of import duties scheduled to start on October 1. Key headline measures include steep levies on selected categories: branded/patented pharmaceuticals (reported at 100% unless qualifying domestic investment is already underway), 25% on heavy-duty trucks, 50% on kitchen cabinets and vanities, and 30% on upholstered furniture. A temporary 90-day truce with China remains in place through November 10.

Timeline and legal risks

Effective date: October 1 (subject to legal and administrative developments). A pending Supreme Court matter and other legal challenges are expected to be addressed in early November, which could alter enforcement or timing. Trade partners may respond with their own measures, and implementation details — exemptions, phase-ins, waivers — remain to be clarified by regulatory notices.

Practical investor implications

- Inflation and margins: High, targeted tariffs can raise input costs and reduce gross margins for import-dependent sellers; branded drug importers, logistics firms, and downstream retailers are first-order exposures.

- Supply-chain shifts: Firms facing sharp tariff hits may accelerate reshoring or nearshoring plans, or seek alternate sourcing — creating capex and vendor‑selection activity in the near term.

- Sector vigilance: Watch U.S. pharmacy distributors, specialty drug importers, heavy-truck OEMs and suppliers, furniture and home‑goods retailers for earnings-impact commentary and inventory management updates in upcoming quarterly reports.

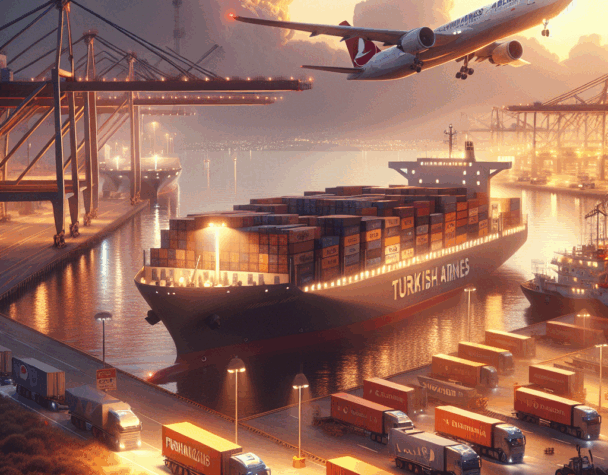

Turkish Airlines’ Boeing commitment: size, structure, and conditions

Turkish Airlines announced an agreement to acquire up to 225 Boeing aircraft: a package that includes widebodies (Boeing 787s) and 737‑8/10 MAX narrowbodies. Reported terms indicate firm and option tranches (e.g., 50 firm 787s plus 25 options, and 100 firm MAXs plus 50 options), with deliveries slotted in the 2029–2034 window. The agreement is subject to separate engine supply deals with Rolls‑Royce (widebodies) and GE/CFM (narrowbodies).

Why this matters for aerospace investors

- Boeing backlog and cadence: A large, multi-year order reinforces Boeing’s forward delivery schedule and revenue visibility, assuming engine and financing conditions are finalized.

- Engine and aftermarket: The engine decision is a material revenue driver for Rolls‑Royce and GE/CFM, and aftermarket maintenance, repair and overhaul (MRO) contracts will follow the final engine selection.

- Regional capacity signaling: The order indicates capacity growth plans for Türkiye and nearby markets; that can affect regional airfare dynamics, slot allocation, and competitive positioning among carriers in the region.

Investor watchlist for the aerospace niche

- Boeing — delivery mix, production rates, financing support and contract finalization.

- Engine OEMs (Rolls‑Royce, GE/CFM) — which supplier wins the engines, and the structure of aftermarket and long-term service agreements.

- Turkish Airlines — financing strategy, capex guidance, and potential fleet rollout timelines that affect short- and long-haul capacity.

Bottom line: tactical actions and things to monitor

Both items are event-driven and actionable. For the tariff story, prioritize checking company disclosures, earnings calls and any regulatory guidance clarifying exemptions or implementation mechanics between now and October 1. For the aircraft order, monitor contract ratification, engine selection announcements and delivery schedules through 2029–2034.

Near-term steps for investors: update exposure screens for U.S. pharma importers and affected retail/logistics names; monitor equities and credit spreads for heavy-truck and furniture suppliers; and track Boeing and engine‑OEM newsflow for order confirmations and aftermarket terms. These are concrete, traceable developments with dates and counterparties — suitable for building short‑ and medium‑term watchlists rather than relying on broad speculation.

If you want, I can convert this into a one‑page investment checklist with tickers, key dates, and specific signals to trigger rebalancing or deeper due diligence.