Dollar Slips as Yields Fall; Yen Firms on Tariffs!

Fri, September 05, 2025Yield Retreat Weakens Dollar Ahead of U.S. Jobs Report

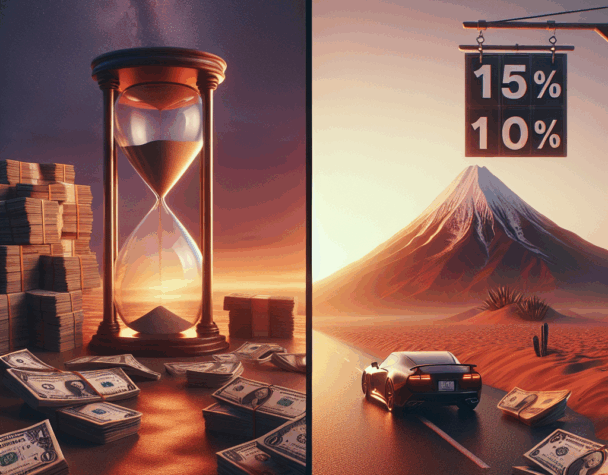

U.S. Treasury yields eased to their lowest levels in several months, and that decline translated into broad dollar weakness across major pairs. With traders increasingly pricing in the possibility of a Federal Reserve rate cut as soon as September, demand for the dollar waned ahead of the U.S. nonfarm payrolls (NFP) release.

What moved rates and the dollar

Bond markets pushed yields lower after recent data and central bank commentary signaled softer inflation momentum and slower growth. Lower Treasury yields reduce the interest advantage of dollar-denominated assets, making the greenback less attractive for yield-sensitive flows. The immediate effect was a softer DXY and gains in higher-yielding currencies.

U.S. Cuts Japanese Auto Tariffs — Yen Strengthens

The White House signed an order to lower U.S. tariffs on Japanese passenger cars to 15%, a policy shift that removed a significant element of bilateral trade uncertainty. Financial markets reacted quickly: the yen strengthened and USD/JPY moved lower on the confirmation that tariff relief was now formalized.

Why the tariff move matters for FX

Trade policy shocks can move currency pairs by changing expected trade balances and risk sentiment. In this case, the tariff rollback reduces a downside risk to Japan’s export sector and short-term trade friction, which investors view as supportive for the yen. The move also reduces the political risk premium that had weighed on JPY, prompting portfolio rebalancing into Japanese assets.

Practical FX implications

- USD — Faces near-term pressure while Treasury yields remain subdued and market pricing for Fed easing rises. Dollar strength will likely hinge on stronger-than-expected payrolls or hawkish Fed commentary.

- JPY / USD/JPY — Tariff relief is a clear near-term positive for the yen. Expect USD/JPY to test lower levels absent a strong U.S. data surprise that lifts yields.

- Risk-sensitive currencies — With yields lower and risk sentiment mildly supportive, high-beta currencies (AUD, NZD) could see additional gains if global risk appetite holds.

What traders should watch next

Two obvious data points will determine near-term direction: the U.S. nonfarm payrolls release and any follow-up details on the tariff implementation timeline. NFP can quickly reverse the yield-driven dollar move if employment or wage data come in hotter than expected. On the Japan side, traders will watch whether the tariff change prompts portfolio flows into Japanese bonds or equities, which would sustain yen strength.

In short: falling U.S. yields have softened the dollar broadly, while a specific policy action on U.S.-Japan auto tariffs has given the yen an extra lift. Traders should treat these developments as distinct drivers — one macro (rates and Fed expectations) and one policy-specific (tariffs) — each with different persistence and risk characteristics.